Even if they settle which more than 90 of cases do maybe he cuts that penalty in halfeven if he knocks 10 of financially its well worth it. Our Values Principles we live by.

Tenancy Agreement And Security Deposit In Singapore What Renters Must Know 99 Co

5 Stamp Duty of 1Cr 1 of 1Cr Registration Charge 5lakh 1 lakh.

. Registration charges for rental agreements in. How much is the stamp duty for a tenancy agreement. Scroll down to see a sample calculation.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. Two months of electricity depending on the type of premises to be paid by cash or cheque. Our Story Get to know us better.

The stamping is to make the Tenancy Agreement legal and admissible in court and is done by the Inland Revenue Board of Malaysia. Depends on the type of apartment. 6 The Minister may make regulations for the purpose of calculating the payment due for overtime to an employee employed on piece rates.

This is a precedent clause effecting an informal apportionment of rent and service charge on the assignment of an old tenancy ie one created before 1 January 1996 when Landlord and Tenant Covenants Act 1995 came into force or after that date but pursuant to an agreement option or court order dating from before 1 January 1996. To adopt the Agreement and Plan of Merger dated as of July 24 2022 such agreement as it may be amended from time to time referred to as the merger agreement by and among IEA MasTec Inc. Our Vision.

RM1 1 year to 3 years. TAX INFORMATION EXCHANGE AGREEMENT TIES -- Agreement which allows governments to share tax and other information with a view to combating tax evasion drug trafficking etc. Even if he loses and ends up paying his legal fees and their legal fees its clear he has determined its well worth it.

8 This section shall. The apportionment is informal as it is only. Customers can only opt for this method provided.

Stamp Duty is the tax levied on legal documents as recompense for making them legally valid. Stamp Duty RM10 to be paid at our Kedai Tenaga. The stamp duty for a tenancy agreement in Malaysia is calculated as the following.

RM2 3 years onwards. RM4 If youd like an additional copy of the tenancy agreement to be stamped as well the. A Total GFA 25 x 150 3.

Referred to as MasTec and Indigo Acquisition I Corp a direct wholly owned subsidiary of MasTec referred to as Merger Sub pursuant to which upon the. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. For Individuals Rights and.

Termination of Account FormLetter of consent from existing account holder. For Companies Company-related topics. One copy of your Sales Purchase Agreement or Tenancy Agreement or any proof occupancy Deposit.

The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. 4 5 lakh. Customer pays the reconnection fees RM 300 for Low Voltage or RM 8000 for Medium Voltage High Voltage and RM10 stamp duty.

Above 10 years 2 of annual rent deposit. Legal fees calculator to calculate legal fees and stamp duty for a Tenancy Agreement. 1B is a lot of moneyhe has obviously determined its well worth it to spend a few million in legal fees to try.

Stamp Duty Registration Charges. Customer pays the electricity deposit. B From the GBI Registration Fees Schedule the fee payable RM20000 c Registration Fees RM20000 200 units RM10000 per unit.

An Orange County estate planning lawyer can develop a system in an estate plan for the handling of debts and also keep a running tally of an estate s transactions during probate. The stamp duty is. Even for a small housing schemes of 25 units of repetitive design with a unit area of eg 150sqm.

Charges for Additional Parking. GFA the GBI Registration Fee is just RM32000 per unit computed as follows. Processing fee of RM300.

7 Except in the circumstances described in paragraph2a b c d and e no employer shall require any employee under any circumstances to work for more than twelve hours in any one day. 5 6 lakh. 1 year or less.

TNB service cable and the premise meter board are present and in good. TAX LAW SOURCES OF -- The main domestic sources of tax law are primary legislation such as acts or laws and secondary legislation such as regulation decisions circulars orders etc. In the state of Karnataka maximum Stamp Duty that can be levied on any rental agreement is INR 500- however it is typically calculated as follows- Up to 10 years 1 of annual rent deposit.

Your Orange County estate planning attorney may also recommend working. TNB installs meter and connects supply.

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Drafting And Stamping Tenancy Agreement

Complete Guide On How To Write A Tenancy Agreement Contract In Ghana

![]()

Tenancy Agreement In Malaysia Lo Partnerslo Partners

Tenancy Agreement Stamp Duty Malaysia Financial Blogger Ideas For Financial Freedom

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Property Malaysia

Stamp Duty Administration And Legal Fees For A Tenancy Agreement In Malaysia Iproperty Com My

5 Important Tenancy Agreement Clauses For Every Tenant Propsocial

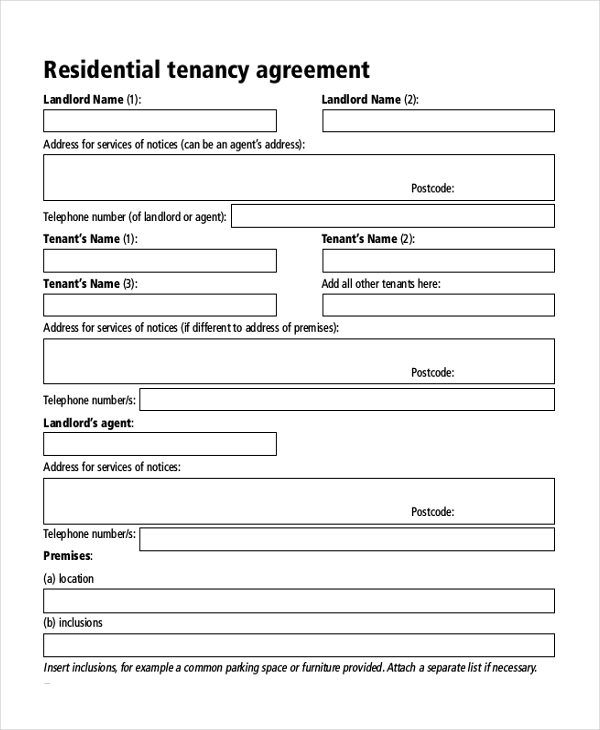

Free 7 Sample Tenancy Agreement Forms In Ms Word Pdf

What You Should Check Before Signing Your Tenancy Agreement

Tenancy Agreement Malaysia Properly

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Tenancy Agreement Vector Art Stock Images Depositphotos

Tenancy Agreement And Security Deposit In Singapore What Renters Must Know 99 Co

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia

What Is A Tenancy Agreement In Malaysia Iproperty Com My

3 604 Tenancy Photos Free Royalty Free Stock Photos From Dreamstime